Services for businesses

Tiresias supports businesses of all sectors and sizes on credit, having created since 2014 the electronic platform TSEK, which offers them online access to the most reliable financial and business information, collected daily on its database. With TSEK businesses can assess their commercial transactions based on objective data and control the credit risk they assume, thus contributing to their growth in Greece and abroad.

In addition, with API services, a business can receive real-time data from Tiresias’ database.

At the same time, the Public Service Office is at the disposal of businesses and freelancers, so that they can be informed any time with safety and transparency, about the data that concern their business or to rectify data if needed.

For your decisions, any time

ΤSΕΚ electronic platform offers any time, easy and online, from any electronic device, a reliable and objective overview of the market, providing data that are daily updated from the database of Tiresias, without the need for any specialized knowledge.

TSEK is a user-friendly tool that supports enterprises by providing them with an increasing number of services, so that they have access to all credit reporting tools they require, in order to grow and avoid potential risks.

What information does it provide?

The data provided through the TSEK platform relate to information entered in the Tiresias records, such as:

Additional services

Be informed about the additional services of the TSEK platform

Which Businesses Can Benefit:

All entrepreneurs, natural and legal persons (SA, LLC, GP, PC, LP, etc.), who deal with credit and assume a related financial risk in their commercial transactions, which necessitates a solvency check of the companies with which they cooperate.

For more information, please visit TSEK page.

API services for businesses

Be informed about Tiresias' API services

Instant Credit ID

Maximize instantly the benefit to your customer relationships

Tiresias' new innovative Instant Credit ID service is an API (automatic system connection) application, through which businesses are able to receive instantly, reliably and transparently, comprehensive summary information on the credit and transactional behaviour of their customer, company or individual, in their commercial transactions.

It provides summary financial information on the type and amount of active credit and loans and their consistent or non-repayment.

Learn more at the TSEK business platform

Balance Sheet Flex

Evaluate immediately companies' financial position

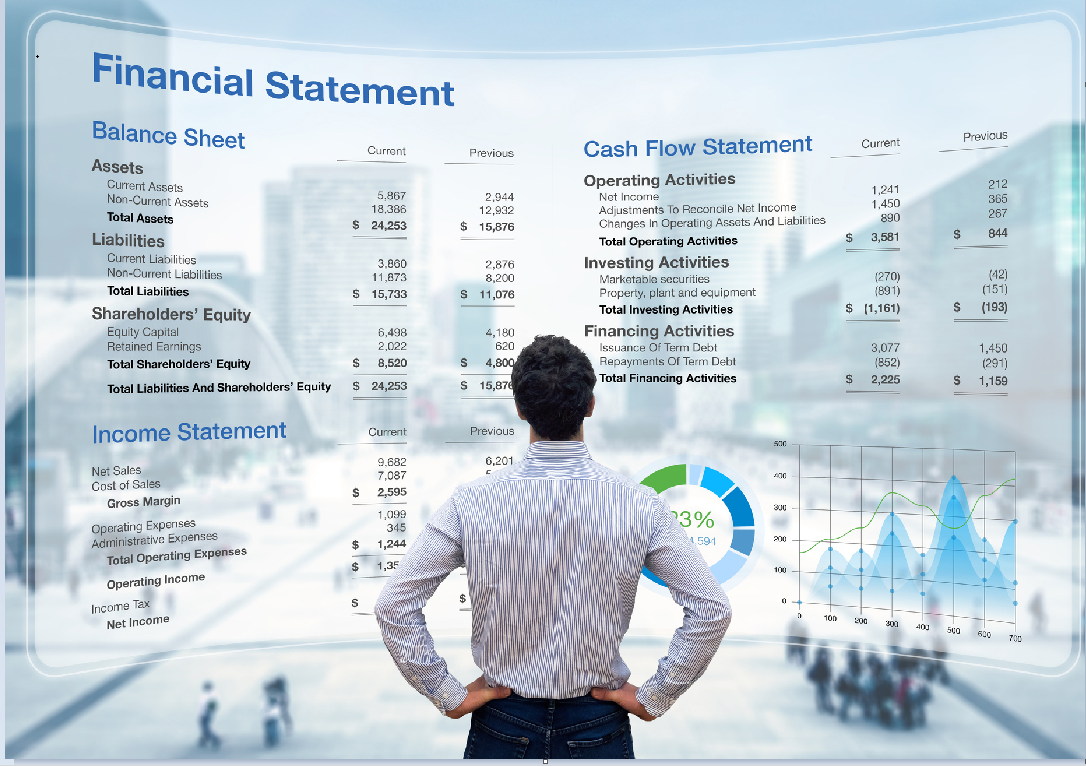

Balance Sheet Flex is an API (automatic system connection) that provides instant access to the full set of financial statements of companies published in the General Commercial Registry and kept digitalized in the Tiresias' database. Thus, you integrate seamlessly and ready to evaluate the financial statement data that you need into your own applications or systems, according to your requirements.

Depending on your needs, your company can request and receive instantly, in bulk or individually, over 270,000 financial statements of companies in summarized or detailed form, for the four most recent years.

Learn more at the TSEK business platform